So, while you’re laughing at their lightning-fast operations, rest assured that your financial records are in safe hands. Founded in 2005, ILM Corp. has been a pioneer in the accounts payable outsourcing industry. With their team of highly skilled professionals, they have built a reputation for delivering exceptional results. A combination of cutting-edge technology, streamlined processes, and a sprinkle of humor to keep their clients entertained. While mistakes are inevitable with any manual process, duplicate payments cost businesses money; a lot of money in fact.

Change Request Error: Vendor Fulfillment Center Differs

To streamline your AP processes, your data submission systems will need to be updated. Ensure your employees are up to date with these to avoid errors or duplication. This is essential to judge how well the outsourcing provider’s privacy and data protection measures match up to yours. However, when you outsource the task to a third-party provider, error reporting can be problematic. It’s easy to supervise your in-house invoice processing activities as your employees are always visible and accessible.

Accounts payable outsourcing vs accounts payable automation

Third-party accounts management companies have modern facilities and software to efficiently and accurately accomplish tasks. Accounts payable outsourcing offers a pathway for companies to enhance efficiency, reduce costs, and focus on their core business activities. In today’s digital age, the technology used by the AP service provider is crucial.

Assessing Provider Capabilities for AP Outsourcing

This flexibility negates the need for internal staffing adjustments, which can be both time-consuming and costly. Outsourcing firms specialize in AP management, ensuring not only efficiency but also strict compliance with evolving regulatory standards. These providers stay at the forefront of industry best practices, offering insights and strategies that might be beyond the scope of an in-house team. This level of expertise ensures that AP processes are handled with the utmost professionalism and up-to-date knowledge, safeguarding businesses against compliance risks and inefficiencies. Outsourcing accounts payable tasks enables businesses to realign their focus towards the heart of their operations – key areas like product development, customer service, and strategic planning.

What Should You Know About RPO for Small Businesses?

If your outsourcing provider charges by invoice, take extra caution to avoid duplicate submissions. Many outsourcing providers don’t have the tools to tell how or when duplicated submissions occur. All vendors and AP employees must be on board with submission systems to avoid problems. The rules-driven nature of accounts payable processes make these procedures appropriate for third-party management. The assigned outsourced personnel are focused solely on a company’s accounts payable systems.

- By outsourcing advisory services to us, your accounting firm can gain access to a broader spectrum of insights and strategies, positioning you as a trusted advisor in the competitive market.

- Our adaptable solutions guarantee you have the necessary resources and support as your business grows.

- In this case, companies are adopting accounts payable automation and in-house processes to get a handle on AP, and it’s an effective solution.

- However, several factors should be considered before embarking on this path.

- AP Automation, on the other hand, refers to the use of software to automate AP tasks within the organization.

On Demand Nearshore/Onshore Solution

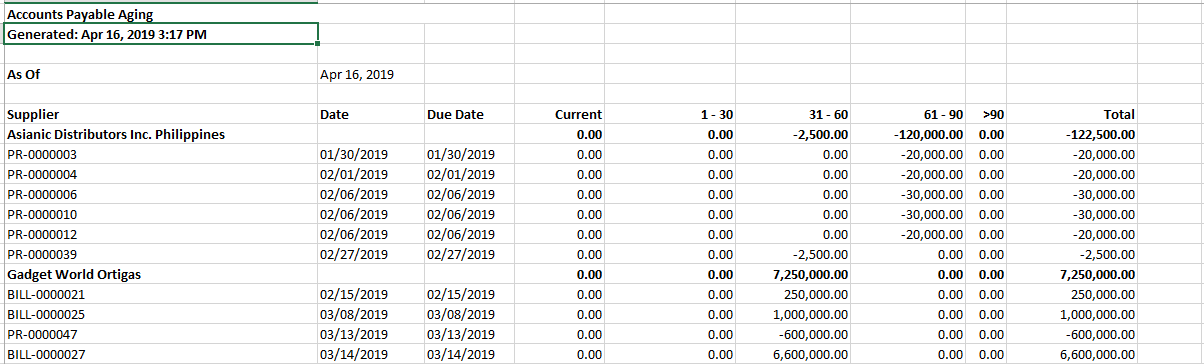

Accounts payable outsourcing entails contracting with a specialized company to handle the processing, management, and administration of accounts payable tasks on behalf of your organization. This includes invoice processing, payment administration, vendor management, and report generation. For many firms, the AP personnel tasks are not always as integrated into the business as another function such as operations, so it can be an attractive offering to outsource some of the paperwork. Of course, there are some downsides to using third-party bookkeeping for contractors specializing in handyman services.

Following the rationale that time is money, businesses use outsourcing to make the most of internal employee time. Typically, these outsourcing firms also store a company’s data on internal servers and cloud storage. A growing company may require more in-house accounts payable department personnel to manage its increasing needs for processing accounts payable functions. Security and privacy issues, company stability, communications, and vendor relationship issues may lead some organizations to opt for an in-house automation software solution instead.

We manage the entirety of the payment procedure, including payment schedules, vendor communication, and payment execution. By optimizing payment cycles and assuring adherence to payment terms, we help you maintain positive relationships with your vendors and maximize early payment discounts. When new vendors or suppliers are added, Account Payable Services can manage the onboarding procedure.

The University is looking into a long-term solution for this error and will provide an update when it has been implemented. Experience accounting excellence with our elite team of US accounting and taxation experts. With a steady stream of talented accounting professionals from QX Accounting Services’ Academy, our clients never face a capacity issue.

Every additional invoice adds further load and over time, dampens AP productivity. If there are limited resources within your accounts payable (AP) department, it’s key to identify how the function can scale to better process invoices when volume increases. This is in addition to all of the other financial tasks you need to take on to keep the business growing.

With their meticulous attention to detail and knowledge of industry regulations, they ensure that every payment is accurate and compliant. So, not only do you save money, but you also avoid the comedic disaster of financial mishaps. With a global presence and a reputation for excellence, Genpact has become a go-to choice for companies looking to streamline their accounts payable operations. Their cutting-edge technology and data-driven approach enable them to process invoices at lightning speed, leaving their clients amazed and amused.

In this case, companies are adopting accounts payable automation and in-house processes to get a handle on AP, and it’s an effective solution. Accounts payable outsourcing can be helpful for companies lacking the resources and automation software to manage their own AP process. As most outsourcing is cash an asset how to organize your balance sheet providers charge per invoice, duplication errors can be quite costly. And as these providers could be thousands of miles away, keeping track of these duplicates can be difficult. Accounts payable outsourcing is a form of outsourcing where a third party team manages your accounts payable processes.

Even before COVID, the drumbeat had started to modernize Finance Departments by offloading transactional, low-value work. But the pandemic accelerated the pace – creating mounting pressure for CFOs to minimize costs, maximize productivity, adjust to a remote workforce, and increase their team’s focus on more strategic activities. Our committed team is committed to providing personalized care, prompt responses, and proactive assistance.

Join our community of finance, operations, and procurement experts and stay up to date on the latest purchasing & payments content. When outsourcing, especially to a third party, any questions must wait for an answer from another business entity. Outsourcing AP companies have employees that are cross-trained under high standards to cover when absences happen. While this does take some of the supervisory duties off your hands, the lack of control can hinder communication, transparency and efficiency.

Skilled outsourcing providers can make a company’s AP processes more efficient; thus improving the cash flow. Outsourcing may help your company cut costs and improve services, but over-dependence on third-party providers introduces more cash basis accounting vs accrual accounting risk. If a third-party company experiences mismanagement or bankruptcy, it may disrupt your accounting services and affect vendor relationships. When a business decides to outsource its AP, a third party manages the AP department.

Automation offers all these outcomes without sacrificing the security or visibility of your AP process. Third-party AP service providers offer professional teams and the latest software to do the job. When you outsource AP tasks to them, you gain access to excellent tools such as computer systems complete with customized invoicing, expense management, and other accounting software.